SITIME (SITM)·Q4 2025 Earnings Summary

SiTime Crushes Q4, Announces $1.5B Renesas Timing Acquisition

February 4, 2026 · by Fintool AI Agent

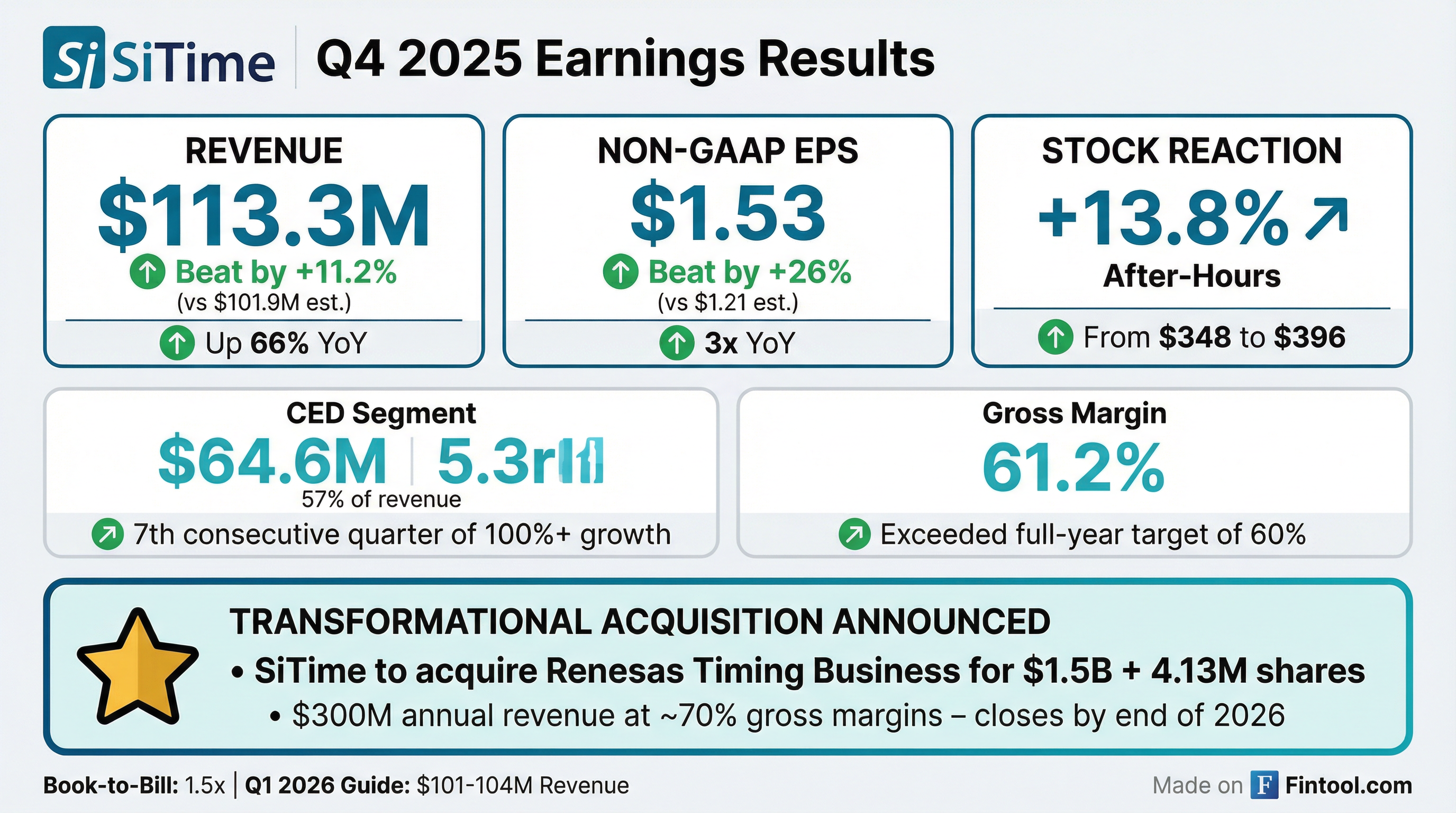

SiTime delivered a blowout Q4 2025 and announced a transformational acquisition. The precision timing semiconductor company reported revenue of $113.3 million (up 66% YoY) and non-GAAP EPS of $1.53, crushing Street expectations by double digits. Alongside the results, SiTime unveiled plans to acquire Renesas's Timing Business for $1.5 billion—a deal CEO Rajesh Vashist called "perhaps the largest and one of the most exciting" inflection points in the company's history.

The stock surged 13.8% in after-hours trading to $396.

Did SiTime Beat Earnings?

Yes — a decisive double beat. SiTime topped consensus on both revenue and earnings:

Consensus estimates from S&P Global.

Revenue grew 36% sequentially from $83.6M in Q3 2025 and 66% year-over-year from $68.1M in Q4 2024. This marks the strongest quarterly revenue in company history and the first time SiTime crossed $100 million in a single quarter.

For the full year, FY2025 revenue reached $326.7 million, up 61% YoY. Non-GAAP EPS more than tripled from $0.93 to $3.20.

What Is Driving the Beat?

AI datacenter momentum is the story. CEO Rajesh Vashist highlighted exceptional demand trends on the call:

"Q4 2025 was another exceptional quarter for SiTime... This marks the seventh consecutive quarter of over 100% year-over-year growth [in CED]."

The Communications, Enterprise and Data Center (CED) segment contributed $64.6 million, or 57% of revenue, growing 160% YoY.

Key demand drivers since November's call:

- 1.6T optical modules: Customer forecasts increased 50% as hyperscalers deploy faster networking

- Super-TCXOs: 2026 forecasts up 50%, used in computing infrastructure and Smart NICs

- Book-to-bill of 1.5x: Exceptional visibility for 2026, with customers booking well into H2

Segment breakdown:

How Did Margins Perform?

Gross margin expansion exceeded management's year-start guidance:

"In the beginning of 2025, we said we would exit the year at greater than 60% gross margins, and we achieved it."

CFO Beth Howe noted margin drivers: "Mix will be the biggest driver of gross margins... CED growth and mix clearly is a very favorable component."

How Did the Stock React?

SITM surged in after-hours trading following the earnings release and acquisition announcement:

The after-hours price is approaching the all-time high.

What Is the Renesas Acquisition?

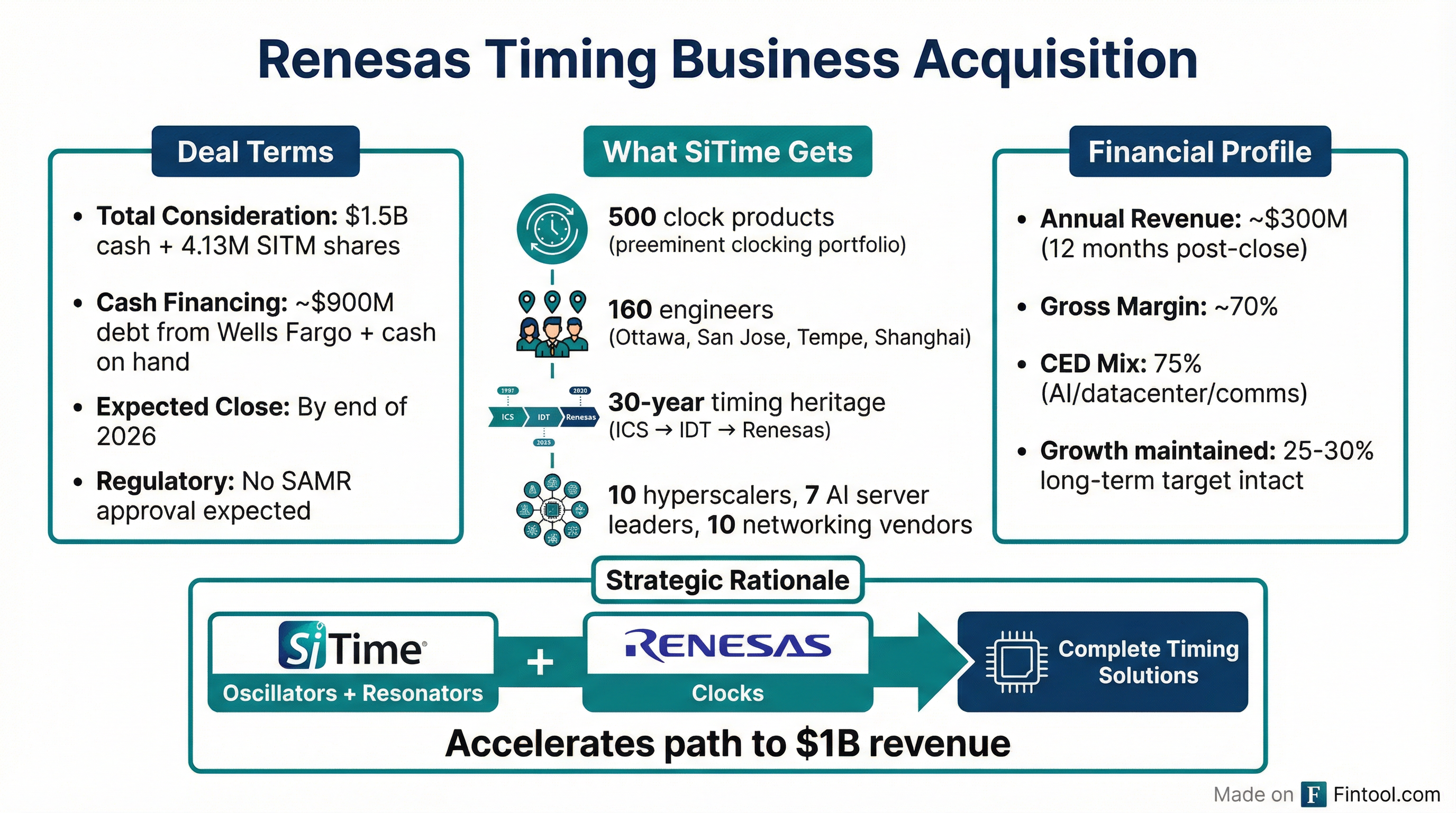

SiTime announced intent to acquire Renesas's Timing Products Division (TPD)—the preeminent clocking business in the industry with 30 years of heritage (ICS → IDT → Renesas).

Deal Terms:

- Price: $1.5 billion cash + 4.13 million SITM shares (with 15% collar)

- Financing: Cash on hand + ~$900 million debt from Wells Fargo

- Expected Close: By end of 2026

- Regulatory: No China SAMR approval expected

What SiTime Gets:

- 500 differentiated clock products (vs. SiTime's current ~50 clocks)

- 160 engineers in Ottawa, San Jose, Tempe, and Shanghai

- Access to 10 hyperscalers, 7 AI server leaders, 10 networking/comms vendors

- Renesas CEO joining SiTime's board at close

Financial Profile of Acquired Business:

- ~$300 million revenue in 12 months post-close

- ~70% gross margins

- 75% from CED segment (AI/datacenter/comms)

- Maintains SiTime's 25%-30% long-term growth target

"This acquisition is a monumental milestone towards fulfilling our vision to transform the timing market... and accelerate our path to $1 billion in revenue."

Cross-sell Opportunity: Minimal product overlap with Renesas customers—their clocks are typically paired with quartz oscillators, creating opportunity to introduce SiTime's MEMS-based solutions.

What Did Management Guide?

Q1 2026 Guidance (excludes acquisition impact—not expected to close in Q1):

At the midpoint, Q1 revenue of $102.5M implies ~70% YoY growth. CFO Howe noted: "Q1 seasonality is expected to be less than historical average and our CED business will grow sequentially."

Full-Year 2026 Outlook:

Management didn't provide explicit full-year guidance but offered strong qualitative commentary:

- Book-to-bill 1.5x exiting Q4 with visibility into Q2 and meaningfully into H2

- Expects growth to "continue to be led by COMMS Enterprise Data Center"

- Each of automotive, defense, and industrial expected to exceed $100M annually in coming years

Current FY 2026 consensus: $443.6M revenue (+36% YoY), $4.31 EPS.*

Historical Beat/Miss Track Record

SiTime has beaten EPS estimates in 9 consecutive quarters:

EPS figures are non-GAAP. Source: S&P Global.

Q&A Highlights

On demand drivers for 2026:

"We grew in 2024 at 40%. We grew in 2025 at north of 60%. The business continues... There is no stopping in the AI data center world. And then there is the inference part of it, or the LLMs come to physical reality, whether it's humanoid robots or other kinds of ideas."

On content gains from 1.6T optical modules:

"The content gains on the 1.6, I think, is going to be pretty good... in the tens of percent up in ASP. And there is an increased number of units being deployed on that, far more than we had thought."

On cross-selling with Renesas customers:

"We have very little product overlap... they are designed in clocking where the solution is quartz crystal. And this gives us tremendous opportunity to expose the values of our semiconductor differentiated MEMS-based solutions."

On supply chain:

"We feel generally very confident in our supply chain. We have had some challenges in the beginning of last year when we were trying to launch new products at the same time when demand was surging. But we're more than caught up."

On physical AI opportunity:

"In humanoid robots, we see up to $20 of a precision timing product, and robotaxis in level 4 ADAS or self-driving cars require up to $15 of precision timing content."

Balance Sheet & Cash Flow

SiTime maintains a fortress balance sheet, though leverage will increase post-acquisition:

Cash flow from operations was $87.2 million for FY2025, up from $23.2 million in FY2024.

What Changed From Last Quarter?

Q4 2025 showed material acceleration across multiple dimensions:

Key changes:

- Revenue acceleration: 36% sequential growth vs. 20% in Q3

- Profitability inflection: First quarter above 30% operating margin

- Strategic transformation: Announced largest acquisition in company history

- Demand visibility: Book-to-bill improved to 1.5x

Key Takeaways

- Blowout quarter: Revenue beat by 11%, EPS beat by 26%—largest beat in recent history

- Transformational M&A: $1.5B Renesas acquisition creates complete timing solutions provider

- AI-driven momentum: Seventh consecutive quarter of 100%+ YoY CED growth

- Margin expansion: Non-GAAP gross margin hit 61.2%, operating margin crossed 30%

- Exceptional visibility: Book-to-bill of 1.5x with strong demand through 2026

- Long-term path: Accelerating toward $1B revenue target with 25-30% growth intact

This analysis is based on SiTime's Q4 2025 earnings call transcript dated February 4, 2026.

Related Links: